Prospect Theory in Practice: How We Really See Risk and Reward

Classical economics assumes investors are logical decision-makers who carefully weigh risks and rewards.

In reality, emotions often override reason.

Psychologists Daniel Kahneman and Amos Tversky demonstrated this through Prospect Theory (1979), which showed that people evaluate outcomes relative to a reference point and experience losses more intensely than gains.

Their research transformed our understanding of risk perception and became the foundation of modern behavioral finance — ideas later popularized in Kahneman’s bestselling book 📘 Thinking, Fast and Slow.

Table of Contents

When Losses Hurt More Than Gains Feel Good

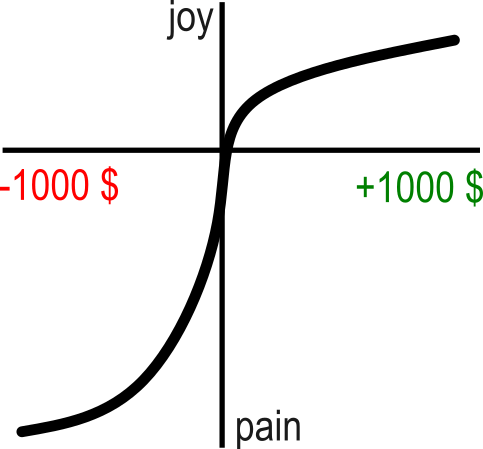

Prospect Theory’s key idea is loss aversion — the emotional pain of losing is roughly twice as powerful as the pleasure of gaining.

Example:

Imagine gaining $1,000 on an investment — it feels satisfying.

But losing $1,000 on another position feels far worse, even though the amounts are equal.

That imbalance can lead investors to hold onto losing positions, hoping they’ll “bounce back,” or take more risk to recover losses.

💡 Educational insight: Recognizing how emotions amplify losses and mute gains can help investors reflect on their reactions during market swings.

Reference Points — The Moving Target

People judge success not in absolute terms but relative to a reference point — often the price they paid or their last portfolio value.

Example:

Two investors each earn $5,000 this year.

One expected $10,000 and feels disappointed; the other expected $2,000 and feels thrilled.

The outcome is identical, but the reference point changes the emotional result.

💡 Educational insight: Awareness of shifting reference points can support a more balanced view of performance over time.

Probability Distortion — Misjudging Likelihoods

Prospect Theory also shows that people overvalue small chances and undervalue likely outcomes.

This explains why high-risk opportunities often appear more appealing than steady returns.

Example:

An investor might put $500 into a speculative stock hoping for a 1% chance of a $10,000 gain, even though the math favors keeping the money in a diversified portfolio likely to return $550 with high probability.

Emotionally, the small chance of a big win feels more exciting.

💡 Educational insight: Understanding how people distort probabilities offers perspective on why markets sometimes favor extreme outcomes.

From Theory to Awareness

Prospect Theory doesn’t label people as irrational — it acknowledges that perception and emotion shape decision-making.

By being aware of these natural tendencies, investors can better understand their own behavior and interpret market sentiment more clearly.

💡 Educational insight: Reflection on emotional and cognitive patterns supports more informed, self-aware investing behavior.